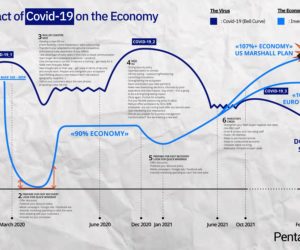

Will our nearshore services in Europe and our offshore outsourcing services in Vietnam allow us to catch the wave better than others? Will the combination of local UX / UI consulting and remote production really prove to be the right combination?

Pentalog achieved incredible performance in the first quarter of this year. The company did not lose a single day of production, even in the second half of March – which is amazing. This was only possible thanks to the extreme agility of our employees, of our customers, and above all of our infrastructure and security team. We can be proud of ourselves.

Trying to forecast the rest of the year is a very tricky proposition, but I wouldn’t feel credible if I didn’t at least try, based on the current state of our contracts and our business.

To this point in the crisis, Pentalog has not lost a single contract. Only two teams were suspended entirely; some teams experienced partial suspension; and we agreed to make some commercial gestures to our more fragile customers. To be able to do this, we turned towards those who are not suffering or who are even profiting from the crisis, and asked them to be rigorous about making payments, so that we can help those who need it. We are responding to the crisis by working together under the ecosystem principle. Quite honestly, everyone is amazing and no one is trying to take advantage of the situation.

Commercially, we also made some fine signatures in Q1 and in the first weeks of Q2, in France, Austria and the US.

After detecting signs of interest from customers who want to be able to grow in flexibility, we have also resumed sustained marketing activities. Strong signs of interest in middle- and low-cost services are appearing everywhere. Pentalog, a company that has demonstrated that it is perfectly possible to combine excellence in both quality and production in both nearshore and offshore areas, needs to take a position accordingly.

The prospect pipeline is still convincing.

What about SkillValue Freelance?

SkillValue achieved Q1 growth of 39%, strongly impacted by COVID-19 in the last two weeks of March, when the order volume for Freelancers fell sharply. We estimate a fall in market demand of 50% since March 17.

Sales picked up a bit in April, but with shorter order durations.

Likewise, we are seeing an unusual influx of freelancers on our platform. Essentially people whose point in common was that they were on assignment on client premises, with no possibility of setting up remote work.

I’m going to go out on a limb with a prognosis of growth in Q2!

Even while I’m seeing all the stock exchange-quoted groups withdrawing their guidance for 2020, one by one, I still tell myself that it must be possible to risk a three-month forecast – while still recognizing that this is a difficult exercise. If I were a shareholder, I would appreciate a little risk-taking.

In Q2, I figure the Group will achieve zero growth, due to a handful of shutdowns and some contract reductions.

Since we manage to recruit remotely, we might even have the chance to sign weak positive growth, if we succeed in finding some new contracts. We have already hired 22 engineers since the start of lockdown! Nothing is impossible!

Further reading:

IT and Digital sector…. Who will survive? And how?

PentaLive: your weekly injection of no-nonsense business talk