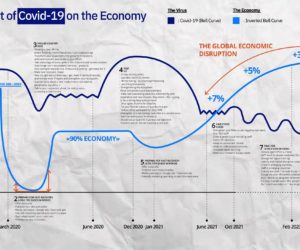

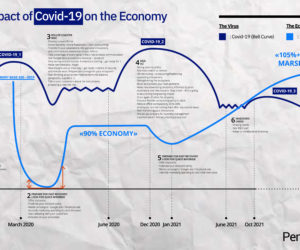

My big takeaway from the events of 2020 is this: Once it has abated, COVID-19 will not have generated the much-feared chaos — at least not economically.

Please note, I didn’t say that there was no economic crisis or that there were no human tragedies. But we should use words precisely. There was no “chaos” because the whole world was going through pretty much the same thing at the same time.

Everyone went through the same disruptions together, slowing down to the same extent, applying similar measures at or near the same pace. So, precisely speaking, until the vaccine arrived, every country was in the same situation, thus avoiding the conditions that create economic chaos.

About that economy … It’s time to start thinking in outcomes.

Philosophically, without the slightest doubt, we know that thinking in terms of outcomes (i.e., results) supersedes thinking in terms of inputs (i.e., allocated resources, expenditure).

With multiple COVID-19 vaccines now available, destinies will start to diverge, and that will play a part in the question of rates and inflation strategies. How did central banks, all of which acted in the same way throughout the crisis, continue to synchronize perfectly while some are now idling and others are throttling to full speed?

That is where national strategies can find an opportunity in decoupling for the benefit of those that will return to growth first.

What are British and American central bankers seeing?

Currently, Britain and America are reporting temporary inflation due to restarting supply chains, fairly rapid return to good employment levels and considerable cash reserves in households and businesses.

More than anything, the British and U.S. central banks think we are looking at a minimum of two years of strong growth. They also anticipate that a little inflation will be around for longer than expected.

The combination of strong growth plus inflation is a great opportunity to refocus on priorities and:

- Let key rates rise a little, restoring value to money, and therefore putting banks back in business.

- Facilitate repayment of debt.

- Foster the productive economy after a decade of easy money speculation.

- Put pressure on European debt while the European Central Bank continues to keep rates down.

I’m not sensing that inflation is back in a big way. Instead, I see an opportunity to use the existing financial windfall and potential for growth — probably higher than expected before COVID-19 — to bring global financial systems back to greater sustainability and to allow American citizens to find more jobs that pay better.

Incidentally, this inflation will let the U.S. government deleverage cheaply while tapering (i.e., gradually reducing monetary easing policy). In addition, a return to slightly higher rates would put pressure on European debt, both private and public.

Why assume such conspicuous growth?

When combined with the savings reserves that a clear recovery will increasingly make unnecessary, a rebound in consumption is inevitable.

As for business investment, it will be conditioned by two simultaneous and brutal priorities: digital acceleration and environmental revolution. Add to this the American willingness to invest in stabilizing the economies of Latin America, and you begin to see the extraordinary wave of investment that is coming in the U.S., and more generally, in the dollar zone.

All in all, consumption will move sharply upward along with simultaneous investments by three generations of companies:

- Pre-digital and pre-green companies undergoing massive transformation

- First-generation web pure players

- Native or near-native COVID business models (i.e., digital, green, remote and networked), which will try to knock out the two previous generations

What about mandatory growth?

When so many forces combine simultaneously, strong and relatively durable economic growth is almost inevitable. Now, I am not claiming that we’re back in post-World War II boom times, but a lot of people are going to try to make us believe exactly we are. We may even see the phrase “Cold War” return to the headlines, following the rumors of unrest in various parts of the world.

But what if the long-awaited digital productivity shows up? And what about green productivity?

After updating my economic plan, I anticipate a potential explosion around 2024 or 2025 when debt pressure will become too strong to sustain everywhere. It would be common sense to think that things cannot go on this way, which is why there’s a question mark after the “BAM” event in the graphic.

There have always been two phases in industrial revolutions: one phase, which we could call “technological revolution,” and a second phase of generalization when the dividend falls, namely “productivity.” Associated as it is with ecological transition, the digital revolution is about to deliver on long-awaited productivity.

COVID is certainly an unexpected accelerator and undeniable proof that you can’t make predictions. But remote work — made possible by technology — will make it possible to recover efficiency in tertiary jobs. This productivity, along with the increase in taxes imposed on global groups, will pay the bill for COVID-19.

And I, for one, am betting with those who think in terms of outcomes. Ultimately, they’re the ones who are always right.

If you need strategy advice or inspiration to accelerate growth, I suggest you check out our business series at PentaLive or our tech talks at PentaBAR.

My team of consultants is also ready to provide their full support every step of the way.

Further reading:

SkillValue and Pentalog services merge, hacking the formula for excellence.

February 22, 2021: The Moment of Truth

Pentalog in 2020: an Open Retrospective