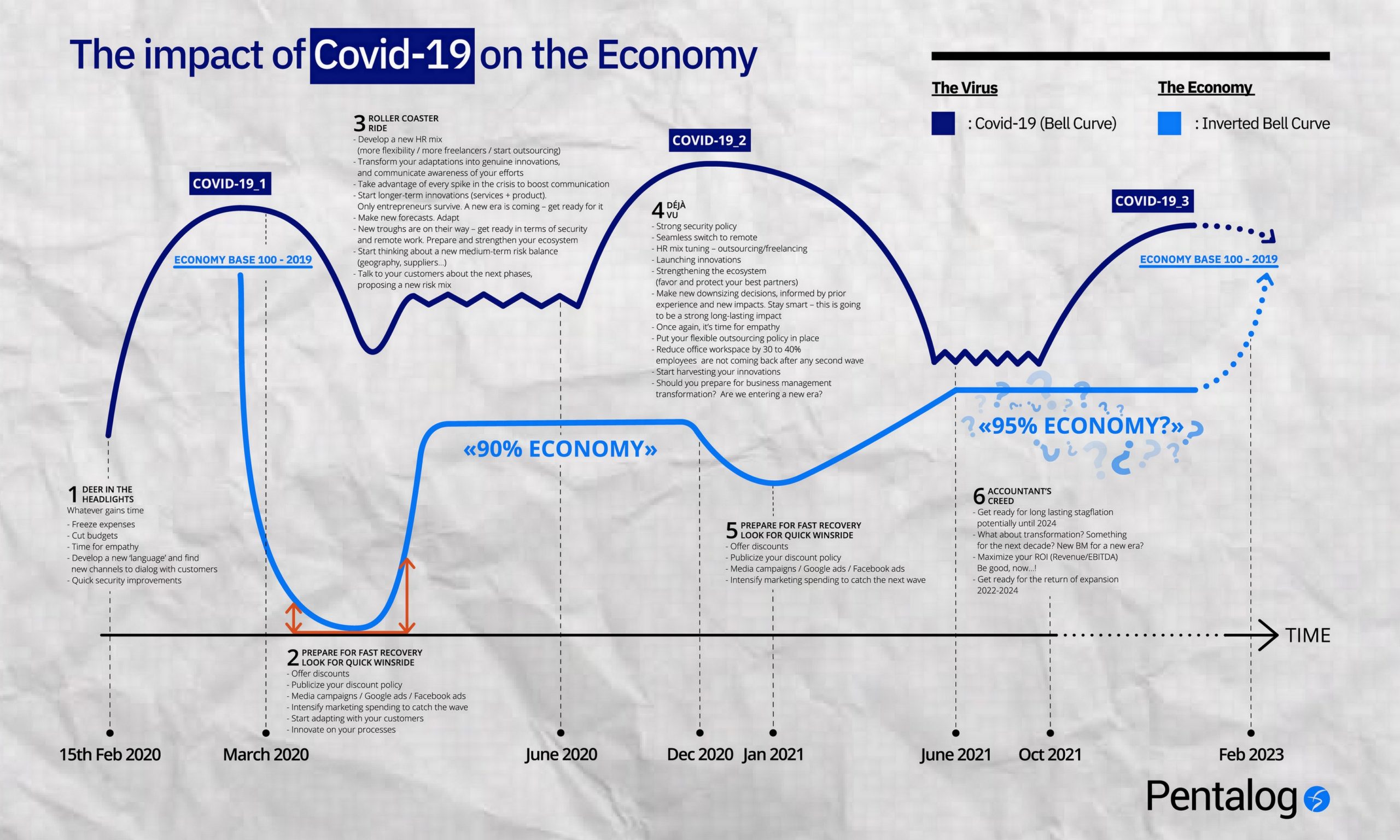

During this time of Covid, I’ve been adapting the crisis analysis that I have been developing for some time now. In the most recent version of that analysis, I projected two events as highly probable.

- First, the winter will be particularly long and deadly. Previous developments in this analysis provided for a single lockdown all over the northern hemisphere, although some countries are going to get two of them – countries like France, the UK, Belgium, Spain, Austria … The countries that acted in time will only get one. (I dream of being Danish…)

- Second, the analysis takes an initial look at 2021, and forecasts a third wave in the autumn, though less strong than the second wave promises to be.

Looking at the latest version of my analysis (published in July), you can see that the behavior of both the virus and of economic agents have been following it exactly. So – a big thank you to the virus and the agents!

Last August, I set up a rendezvous with you for this November 23rd, to describe a plan to end the crisis which will start to kick in next year, and which will depend on how we handle the second wave. Blame nihilistic morons for the fact that it’s not going to go very well – even if we shouldn’t be holding requiem services just yet!

By November 23rd, I forecast, we will have so much data from so many countries that we will be able to infer some dates for the start of a global recovery following the second wave.

Let’s take a peek at this new version and get an idea of the choices that will be available to us for high performance – even during this new episode of crisis.

Once again this time, the winners know how to articulate around three points:

- Being able to initiate even more cost reductions, but ones that do not hamper their capacity for production and growth. Take an example from our own company: we have decided not to renew the lease on our New York premises, even though we are growing in the US (and everywhere else, too, for that matter). But we have to do it, even if only to strengthen our margins, at a time when we don’t really need premises anyway. We have also sublet part of our offices in Paris, given up 50% of our premises in Bucharest, and obtained reductions of between 20 and 30% on all the other real estate centers that we have not decided to divest at this time. In any event, this is the direction of history, and it was, even before. This makes up for what we have dropped to help our customers.

- Carrying out a series of very specific marketing actions very quickly, that can take advantage of the intense recovery that will follow the first lockdown, the second lockdown, and the resurgence in the spring of 2021. The first thing you need is to know how to find your words – refining the tactics you developed in the spring, promoting your innovations better, making irresistible offers. To get through the winter, you’re going to need a lot more leads than usual.

- We said it this summer – anyone who is painlessly relying on budgets for 2021 that are decided at the end of 2020 was seriously wrong. Because this fall promised to be somber – and it is. If you were following us, then you built and powered deals like never before. So at Pentalog, we ended the summer with more leads than ever, a pipeline with ups and downs, sure – but by the end of 2021, with a backlog of 86% of our 2020 turnover! And growth of almost 11% in this crazy year. You had to take control in Q3, when morale was good. Do you know the story of the Grasshopper and the Ant? We saw an awful lot of grasshoppers this summer…

So everything is going to play out with very fast timing in very fast sequence!

But there’s more. The winter ‘tunnel’ is going to be long, and you will have to continue talking, and managing an agenda with your targets. To demonstrate that you are on top of the unfolding crisis, you could copy-and-paste my analysis – reworking it and customizing it to your situation.

You’re also going to have to change your ICP (Ideal Customer Profile), because the redistribution of cards between sectors is getting clearer every day.

Besides the increased intensity of the second wave, what also changes in my analysis is the introduction of those longer changes, along with a recovery that is stronger than I anticipated in July. The third quarter of 2020 has rebounded so strongly that I no longer believe in a plateau at 90% of the 2019-level, but 95% or maybe even a little more for the end of 2020. In that case, the 2019-level might be attainable in the second half of 2022.

Further reading:

Coronavirus: What if the pandemic lasts 5 years? How about 10?

COVID on November 23: The End, or a Repeat?