As Europe approaches the first anniversary of the Covid-19 pandemic, the moment of truth is also coming up for the scenarios – optimistic or negative – that various players have developed.

A triple turning point, in fact: for the vaccine of course, but also for the connected question of mass immunity, and the imminent return of the more favorable season in the northern hemisphere.

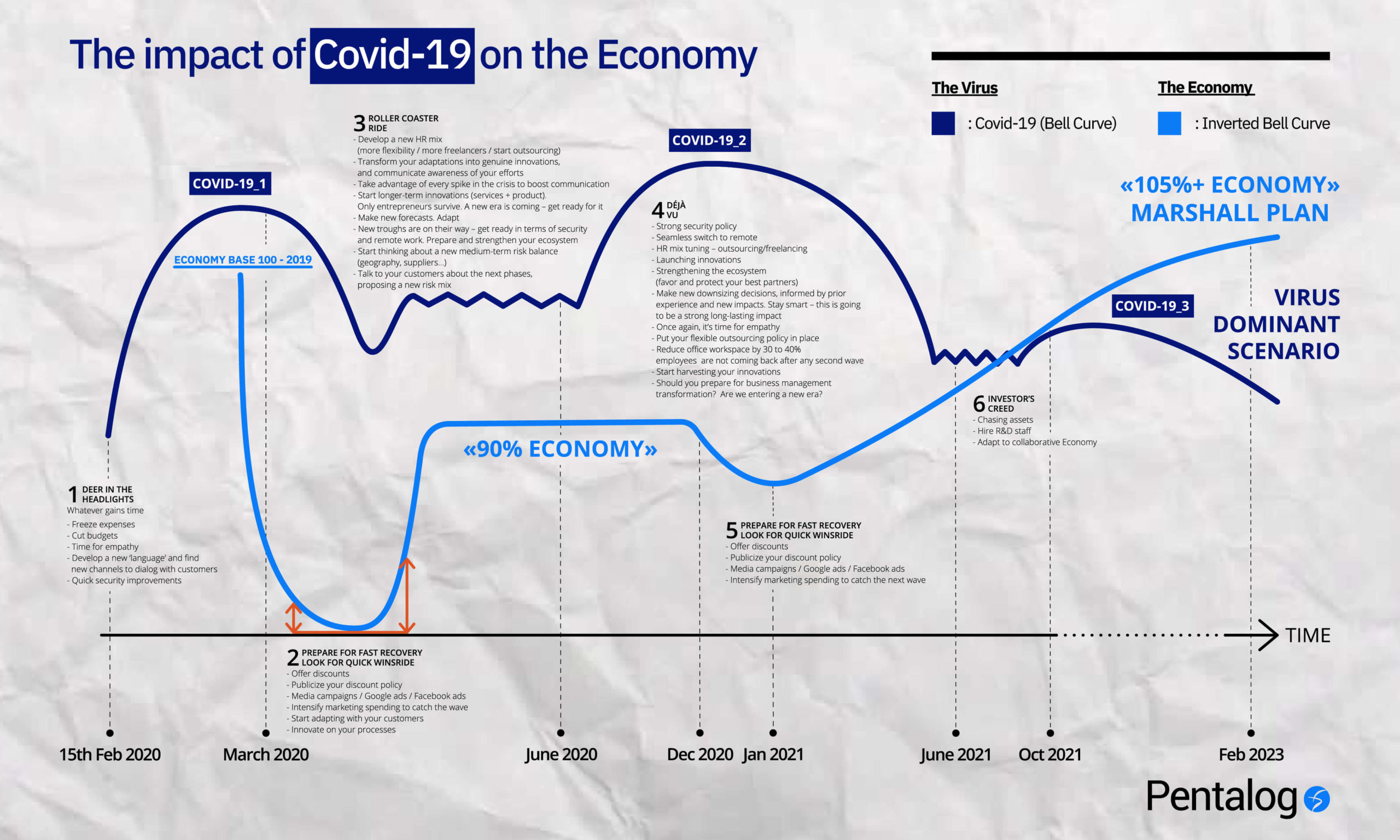

So this is, among other things, the case for my main scenario, the scenario in which I continue to believe the most; specifically: towards the end of springtime, a relaxation in both the virus and the economy – depending on how the economic actors anticipate things following the month of March, and whether or not we go into more lockdowns in the northern hemisphere.

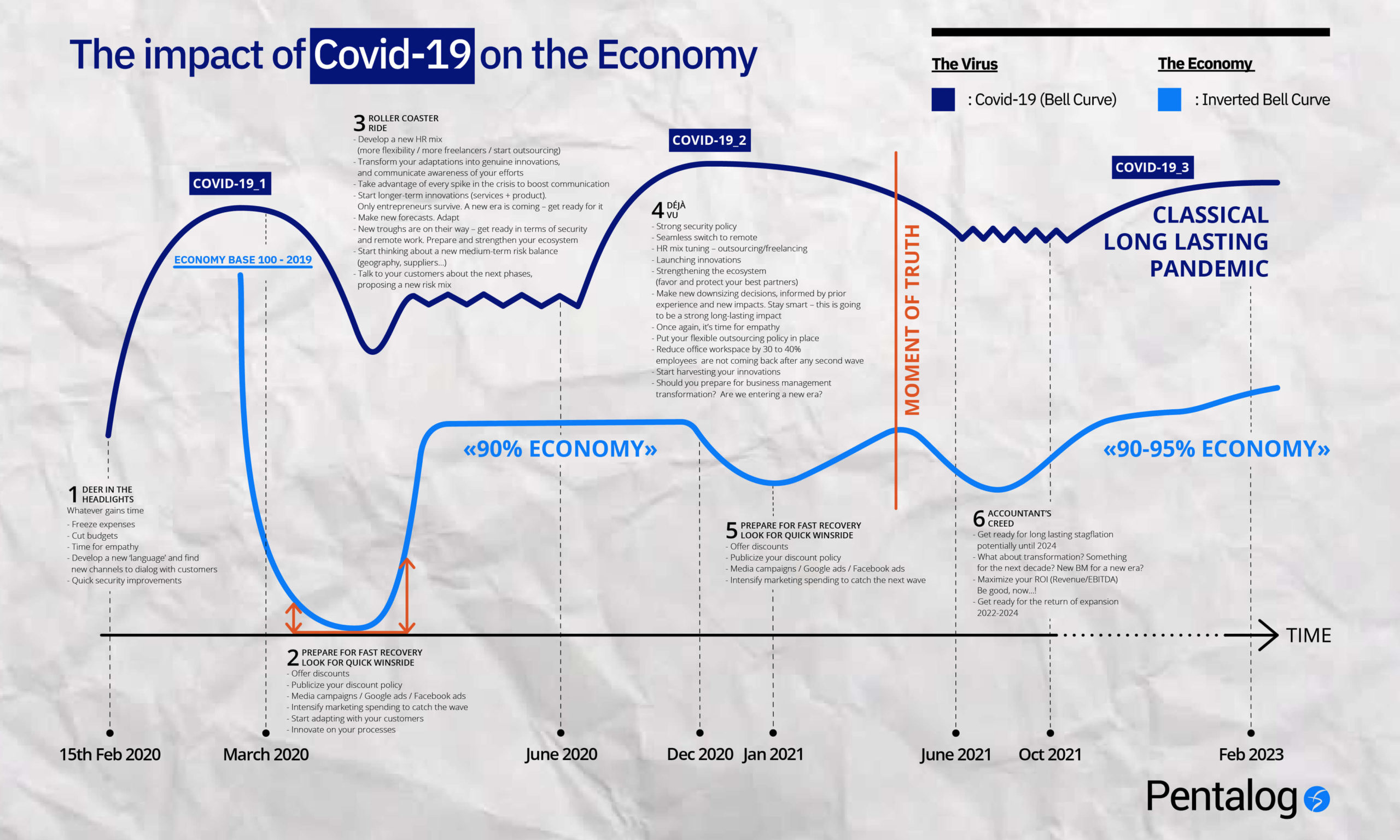

However, I wrote a paper a few months ago, based on a more historical analysis of pandemics. That scenario is more worrying, since their average duration is 3-4 years.

Clearly, economic destiny for the two cases is not the same. Political and even historical destiny could also diverge sharply.

So I have decided to qualify the period currently opening up as the Moment of Truth. Very soon, we’ll know if we’re coming out of the tunnel, or if, on the contrary, we will prolong our journey in sadness and emptiness.

Moment of Truth

In fact, there will be several key moments, several verifiable facts, which will light up the media, politicians, commentators – all those people who live in confusion rather than facts.

Those facts, no matter how closely we monitor them, can stubbornly diverge at any time, and show us that even the most scientific, rigorous approach does not necessarily sum up the future.

For my part, I built my economic plan on governance of the virus, and the long-term interests of the financial industry (the behind-the-scenes backbench for central banks), all the while correlating it to the essential phases of the pandemic, at least for what was predictable – namely, a marked worsening in winter, when people live indoors in humid atmospheres. Nothing original there, just simple, scientific observation of coronaviruses.

So far, the situation has unfolded as expected. My economic analysis has also held up perfectly. Over the year 2020, the countries of the northern hemisphere devolved downards, between -4% and -12.8%. The best can be found in Denmark, Norway and the US. The worst (in order) are Spain (-12.8%), the UK (-11.3%), Italy (-8.8%) and France (down 8.3%). We often forget to notice that these four countries – major tourist destinations – were particularly affected.

To try to understand the mechanism behind this moment of truth, you first need to seek the moments of truth yet to come. Here is a list that should explain 80% of what will happen:

- Visible effects of the incredible Israeli vaccination operation. At the current speed, Israel should see the first effects of its campaign within 3 weeks! Especially since the population has recently been greatly affected. If everything works as planned, prevalence rates are expected to collapse by mid-March or early April. This will be the phenomenon most observed in the coming weeks by the worldwide media.

- The first large country in terms of its population that will reach this moment of grace should be the UK, where the threshold of 25%-vaccinated should be crossed at a time when at least 15% of the rest of the population will have been affected by the virus. In other words, around mid-May, early June, the UK would have emerged from the crisis, since in fact, more than 40% of the population will be immune. The rest of Europe will not reach the same threshold until around September / October, or even December. Which is how you choose your destiny. But for that, decisions need to be taken quickly and implemented quickly. Continental Europe will pay in the very long-term for the consequences of its slowness in vaccination in this crisis.

- The acceleration of the appearance of variants and their relation to existing vaccines.

- The end of spring. Will we have, as we did last year, an extremely favorable climate? Will the effect of the sun be enough to counter the incessant flow of contaminations?

- Economically, will new economic aid, particularly in the US, be effective? At this point, the work of central banks and governments around the world, inspired by necessity in common, has been very successful in containing the crisis. Will that still hold in Europe when the Americans, the English and the Asians, all recovered, withdraw their aid?

I wonder if the Europe which is so slow to vaccinate has realized that the US is already back to growth, and that China, which has regained its cruising speed, is now poised to outperform its average pace. The European views the ordeal as inevitable, the American as a challenge, the Chinese as a mission. Obviously, these three do not come out to the same end. The complaint from Brussels about labs is simply odious. That doesn’t stop me from admiring the choice of a unique continent-wide program. That’s fine, but it should have been done in the spirit of ‘firsts’: first to buy, first to deploy, first to be vaccinated.

In any case, considering the choice of the pace of the campaign, Europe will fall between 2 and 5 quarters behind in the objective of collective immunity, and even more in the objective of economic recovery.

By the end of July, 70% of world GDP will have emerged from any health crisis, and will be able to give free rein to trade, while Europeans will still be subject to numerous restrictions. Gaps in growth are already staggering, and will remain that way for quite a while.

This period will figure in history as the time when China’s economy catches up with the West. Few commentators are saying it, but Chinese economic history is about to turn a page.

We are only talking about the favorable scenario.

On the other hand, if one or two very aggressive variants were to fall off the spectrum of vaccines, or worse, if Israel were to experience a strong wave in the next eight weeks, then there is no doubt that positive expectations would disappear, giving way to a wave of pessimism that we have not known since May 2020. These appalling hypotheses would pave the way for entry into the classic visions of major pandemics, namely, a pattern over 2 to 4 years, which as I have previously written, would cause enormous economic disappearances of entire sectors, not to mention the political risks caused by a very long period of chained disasters.

I present this scenario in my second diagram below, but at this point, I will not detail any tactics for adapting to it. I will do so if I see, for example, that the Israeli campaign is not producing the desired effects. For whatever reasons.

Let’s come back then to scenario 1: an end to the crisis in 2021.

So what to do? How to take advantage of the upturn before the others do? How to surprise the market and outperform your competitors?

For a whole slew of reasons, mostly scientific, I insist that this scenario is overwhelmingly dominant among risk specialists, epidemiologists, traders – and with fortune-tellers. This confidence comes from having several vaccines on several different technologies, and many vaccines still to be released.

As for variants, our view today is aggravated by the speed of auto-generation, but this does not come from the heart of the virus or its particular ‘genius’; it comes from our DNA sequencing capabilities. We must not be fooled. It is rather our analytical capacity that has exploded, not the speed of mutation of viruses! We are victims of the magnifying effect caused by an unprecedented sequencing activity.

In this probable positive development in the situation, the rebound in preparation should be even stronger than I had expected, with complete exit from the crisis of certain countries, including the US, from the start of Q3. But ultimately this is also the case for China, Japan, Korea, UK and finally, almost all of Asia.

As I said above, I think almost 70% of global GDP will be completely out of the crisis by the end of June. I had not anticipated such speed. I think that in this zone, we will see phenomenal growth from the second quarter, with a climax in Q3. In Q4, Europe, which will have experienced rapid improvement but much slower relative to the Brits and the US, will, in its turn, experience very violent acceleration.

What’s the score for companies?

Companies in the northern hemisphere need to target the universes of Asia and the Anglosphere as much as possible. Last week, a pretty well-known French tech boss was telling me about the strong recovery in China, while I was telling him that we are currently experiencing 30% organic growth in the US. So – QED, as they say.

Now is the time to prepare your offering for these countries; from March 10, they will be drowning in a sea of cash and optimism!

If you perfect your business tactics, the customers will come. Indeed – they’re already there.

In continental Europe, Germany and France have handled the pandemic well to this point. But restrictions will remain numerous and may even increase due to the extremely slow administration of vaccine doses. Eastern Europe has all but extinguished the virus and industrial rates will resume. I expect a great Q2 in Eastern Europe. Connected to German industry, exporting its luxury goods to euphoric areas, it will perform. Eastern Europe will benefit greatly in 2021-2022 from its status as a reservoir of competitiveness, in a free trade area!

Germany, Central and Eastern Europe are therefore also areas to market to in Q1 and Q2.

The UK, Western Europe and Scandinavia will only really start to feel the effects in Q2. On the other hand, the boom will be very intense for our Brexiting friends, extremely weakened by the current crisis.

In France and throughout this region therefore, I advise entrepreneurs to adopt a discourse on exiting the crisis and investing with their local clients.

The best of them will do as well as the Anglosphere in taking advantage of the huge financial windfall that governments, Europe, and Joe Biden are going to rain on our heads. It’s up to you, entrepreneurs and decision-makers, to know how to anticipate it!

So don’t lose heart – the end is in sight! Pay close attention to the first signals from the Middle East and the UK!

If you need strategy advice or inspiration to get through this period, I suggest you check out our business series at PentaLive or our tech talks at PentaBAR.

My team of consultants is also ready to provide their full support every step of the way.

Further reading:

Pentalog in 2020: an Open Retrospective

Poland, the best coding nation in the world, becomes the 8th country for Pentalog!

Pentalog’s Secret to Hiring Top Tech Talent? Coding is Just the Start.